One of the less talked about benefit of visiting Georgia is direct access to great banking services.

You don’t even need to move to Georgia – a very short trip is enough to open an account, and you can then handle everything online after your visit.

It used to be ridiculously easy to get a bank account in Georgia. After the sanctions against Russia were tightened, they do ask a few more questions, but opening an account is still pretty much a one-and-done deal (if you have a non-Russian passport).

If you, as a foreigner, try to open a bank account in the US or EU, you can pretty much expect to be interrogated like a criminal. The scrutiny is very tight, because the regulator is breathing down their necks.

Opening an international (USD/EUR/GEL) bank account in Georgia is an extremely friendly experience. They treat you like you would expect a business to treat a customer!

Banking as a location independent person can be difficult

To understand why banking in Georgia is easier than almost anywhere else, you need to understand why it’s become increasingly difficult in the “legacy countries” – especially for people with international lifestyles.

These same problems also apply to the Fintech companies (Wise/Revolut/etc), making life difficult for location independent people.

If you only live in your home country, get a wage from a normal 9-to-5 job and don’t send money abroad, you may not have noticed much issues with banking. However, if you “deviate” from this norm even a little bit, you have probably noticed how suspicious the banks are of even regular tiny transactions.

Even if it hasn’t happened to you, you’ve probably heard stories of people having to answer very invasive and detailed questions of money transfers, or face the consequence of having their accounts frozen unless they comply.

Or, as recently happened to Svetski – they can just freeze your accounts even if you do comply. He’s not the only one, as I’ve been hearing these same stories constantly as long as I’ve been location independent.

The reason why this is getting increasingly bad fast isn’t that the banks have suddenly turned evil, but because the regulators are breathing heavily down their neck to “prevent all crime, or else!”.

When the banker, legitimately, complains about this and asks:

-“But we can’t prevent all crime, we need the police to tell us about criminal activities!”

the response of the regulator is:

-“That’s just too bad, you WILL prevent crime or we will pull your banking license!”

Legacy banks are forced to treat you as a criminal unless proven innocent

The fact that the banks are still not armed with any real tools to actually prevent crime puts them in a very difficult spot. Either they comply with very vague but heavy-sanctioned regulations, or they may actually lose their whole business.

Essentially this forces them to treat everyone as criminal, lest they be accused of not doing so in case someone actually happens to be a criminal.

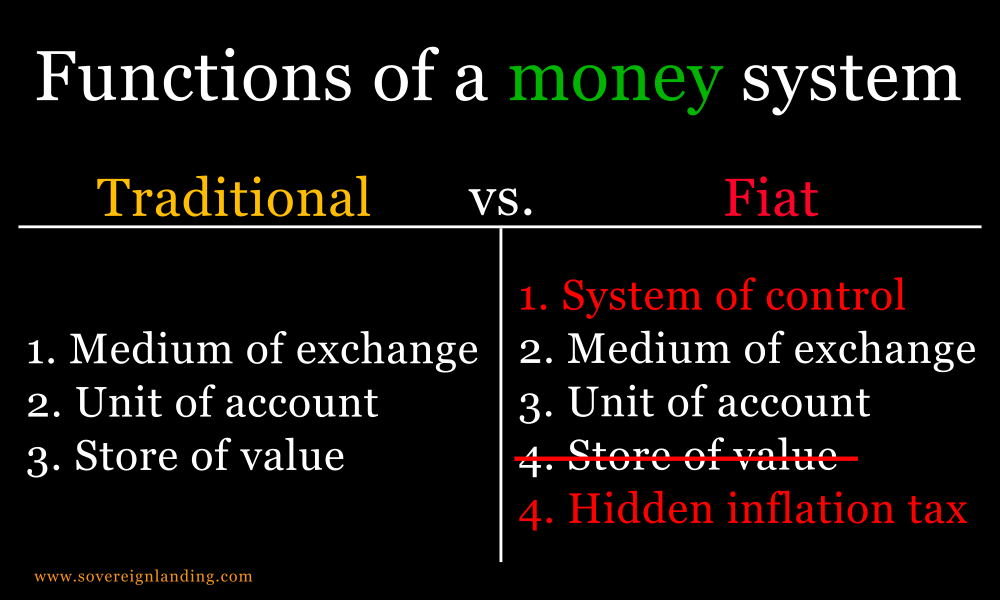

This system is (broadly) called KYC/AML – it’s short for Know Your customer / Anti-Money Laundering. It is a classic example how the road to hell is paved with good intentions. When the job to implement this is given to unelected faceless bureaucrats, you get the system described above.

The legacy western countries are becoming more and more authoritarian, especially when it comes to anything financial. Banks are at the tip of this unfortunate trend, as they’re the lowest hanging fruit for this machinery.

It is very common for location independent people to accidentally get ground down in the gears of this KYC/AML machinery, usually with no recourse. We’re just collateral damage.

It's not the banks that are doing this to you...

While the regulators are advertising these KYC/AML systems as a "protection against criminals", they do not actually work as such. Money laundering is still very good business for banks, because when they get caught red-handed doing it, the fines they have to pay are a tiny fraction of the profits they've made.

Rarely, if ever, do the executives go to prison for knowingly aiding criminal organizations. Therefore it can be said that professional money laundering is the specialized business of big banks - when done "right", they can get away scott-free and make huge profits with it.

They can - you can't. I'm not arguing that you should get away with crime - that isn't the problem here. The problem is that you can't conduct your daily, legitimate banking business because these systems are interfering with the banking of every honest individual. All while the KYC/AML regime is really not a problem for the actual criminals!

Do the regulators benefit from allowing this criminal activity? Perhaps not directly (or perhaps they do, but I have zero proof) - but indirectly this system is so broken that in my mind it counts as at least a crime through omission, if not direct causality. They benefit from having the control over everyday people.

You shouldn't expect this regime to get any better. They have no incentives to let go, and every incentive to keep on strangling people and businesses ever tighter. They don't really care about crime - they're after more power.

Remember: it's not the banks that are behind this system - it's the government(s). When you're being mistreated by the banks, don't blame the people working there! They're just stuck between the rock and the hard place.

The authoritarian trends are not the same in every country

One thing should be made clear – Georgia does have their version of these same systems in place, and they do not welcome criminals, so don’t go there if your money is not from legitimate sources.

Having that out of the way, let’s focus on the real thing: legitimate banking needs of everyday people and businesses.

For this purpose, you need to understand that while the regulations are the same on paper, they can be interpreted through wildly different lenses.

Same rules on paper, night and day difference in the experience

While Georgia is not completely immune to these same totalitarian trends, they do have leeway in how heavy-handed they are with implementing and interpreting the regulations. As a slightly remote, small non-EU country, they can’t rely on a “legacy status” like banks in the bigger countries can – they have to actually try to draw in customers.

Customers who choose to come there voluntarily.

The end result? Same regulations, night and day difference in the banking experience! Having opened bank accounts in many different countries, I can say that Georgia is probably the best I’ve experienced. You can open a bank account with one simple visit, and then wait a day or two to get your physical debit card. It really is one of the easiest ways to get an international bank account in a real bank.

This bank account sits outside the direct stranglehold of the near-bankrupt legacy countries. You can use it for easy day-to-day banking like it used to be before – when the banks weren’t forced to treat normal people as criminals.

Opening an account in Tbilisi is so easy that you don’t really need our help (just walk into any TBC Bank branch in Tbilisi with your passport and ask to open an account, they’ll serve you in English), but as our customer, we can come and help if you want someone to accompany you!

Beyond Georgia - how to arrange your location independent finances?

This might require a whole post by itself, but here are some quick pointers:

1. Move your finances off the fiat system of control as much as possible, and into bitcoin where you're in 100% control of your money. Favor non-KYC bitcoin if possible (buy from people you know or earn bitcoin, avoid exchanges).

2. To the extent you need to interact with the fiat economy, just be aware of the problems outlined in this post when dealing with banks. Act accordingly, be proactive and plan ahead a bit. Open local accounts whenever possible, and keep your money outside the US/EU/Commonwealth banks.

3. Use money as locally as possible, and try to minimize the amount of transfers. Move larger chunks at a time, but try to keep the amounts under $10,000 (an automatic red-flag limit in many bank systems). Banks (regulators) consider cross-border payments a risk, so keep that in mind.

4. When possible, use cash. The best way to use it is to exchange bitcoin directly to cash, even if that can often be complicated.

0 Comments