Money is broken – and it’s your time and energy at stake

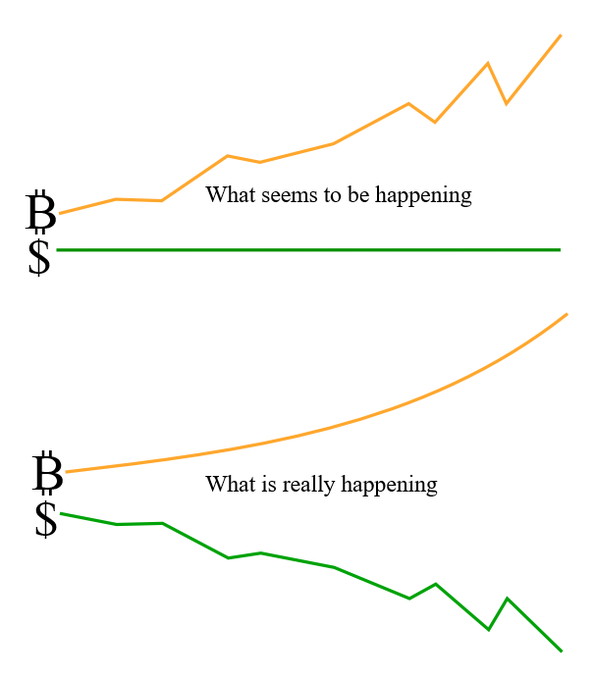

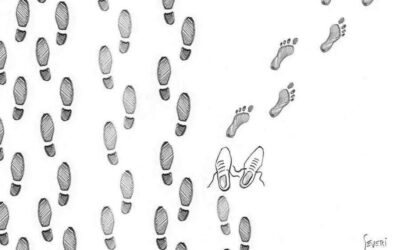

There are two kinds of people.

The one on the right, representing the vast majority of people, unknowingly allows their time to be stolen by the money printing parasites.

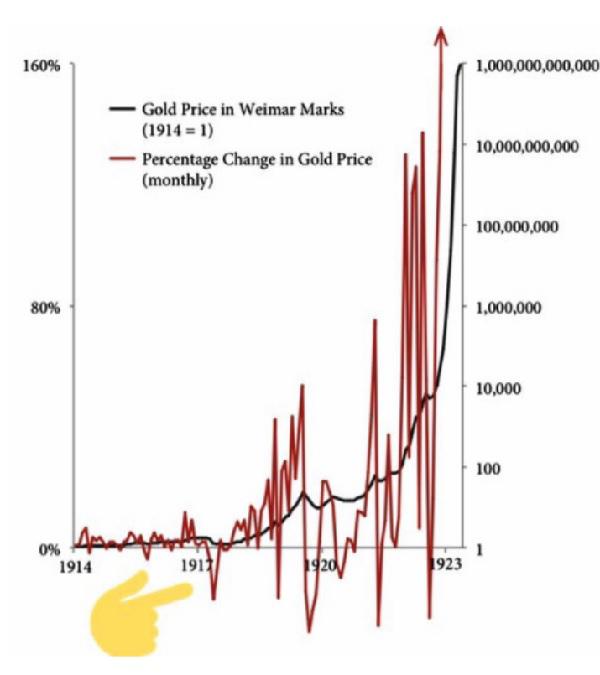

While the government may not be officially in charge of how much money gets printed, in practice the veil between the politicians and central bankers is thin at best. The only real reason why money is printed at all is to pay for government excess. Money printing (the source of inflation) is a hidden tax, the benefit of which is mainly collected by the state. There are also other beneficiaries of this: large companies and other actors at the top rungs of the “fiat pyramid”.

This top-favoring benefit is called the Cantillon effect, and it is the main source of unfair inequality in our societies… and it’s growing, because the money printing is heating up.

Chasing dollars will keep you on the hamster wheel forever, because fiat money (dollars, euros etc) is designed to make you do exactly that.

If the government can print money, why do you need to pay taxes?

No amount of money printing produces any goods or services. People do. You need to pay your taxes in order for the government to have something real to collect, and money is printed to keep you producing these real goods and services faster while getting less and less of the benefit for yourself.

The governments can’t print bitcoin, and are therefore unable to make you run faster (except by increasing taxation, but that has an upper limit) – but only if you keep your savings in bitcoin.

Keeping money in government paper means that your purchasing power will get diluted. Their debt loads give them no other choice! This problem comes both with fiat cash (physical or money on bank accounts), and with bonds, which are a promise to give you more fiat later.

In the past, bonds were considered to barely beat at least nominal (if not real) inflation, but not anymore. The governments handing out these debt promises are too bankrupt to ever be able to pay back those promises in full. They will have no choice but to print the money to pay back the debt, devaluing it in the process. Real purchasing power can’t be printed.

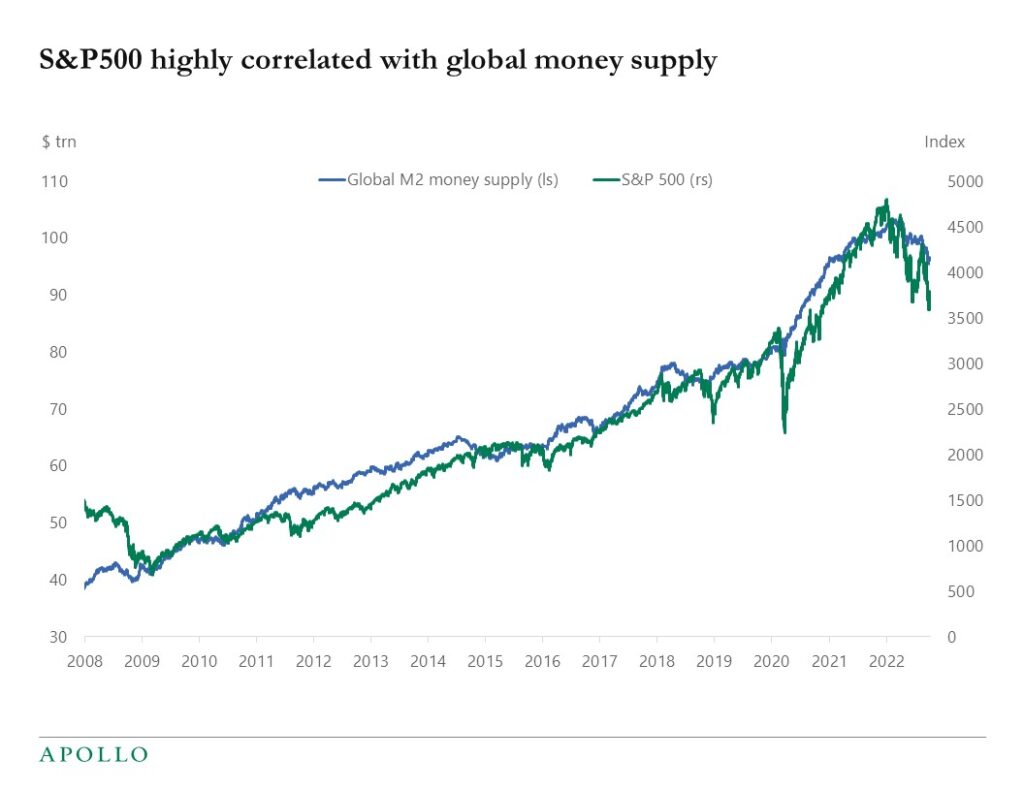

What about the stock market?

Stocks are not inherently “fiat money”, but they are effectively used as a savings vehicle, and therefore a large portion of this overall fiat problem “flows downstream” into stocks as well. The S&P 500 isn’t gaining in value against the money printer – it’s stayed essentially flat against the money supply growth since the 2008 financial crisis.

Therefore, if you invest in the stock market, you can maintain your purchasing power, but you are carrying the risk of owning those companies – and many of them are zombie companies, as a result of the stock market being used as a savings vehicle.

Because stocks are used as “money substitutes”, the price to earnings (P/E) ratios of these companies have gotten completely out of hand. Personally, I wouldn’t want to get caught up in the process of those stocks getting repriced to sane levels…

When a company gets into the S&P 500, their stock price goes up “automatically” because of the automated money flows into the index. At that point that company can kick back, relax and essentially forget about working hard for their customers – the stock price will go up if they just keep up the appearances of being a company in a competitive free market. They don’t really need to compete – it’s enough to just keep their old operations going while making their profits from all kinds of financial shenanigans.

This short video clip from the interview of Sotheby’s ex-ceo is worth watching.

So, what’s that ultimate and final answer to whether it’s a good time to buy bitcoin?

I would ask that same question in a different way:

Is now a good time to start your journey off the fiat hamster wheel of having to run ever faster while being paid in ever-dwindling purchase power?

I don’t know – if I were you I’d do it like yesterday, but it really is up to you.

You won’t get off the hamster wheel immediately, which is what most people are looking for. They end up aping their money into different scam projects and have to run even faster just to make that money back.

Understanding the basics discussed above goes against everything most people have learned about money, and so most people will stay on the fiat hamster wheel.

I’ve learned to accept that, and I’m not going to fight anyone on this. You do you, and I’ll do me.

The above facts about the money being broken are so obvious to us bitcoiners that often we, especially the new ones, are shouting these things from the rooftops trying to get everyone we know to start stacking as fast as possible. Then they get ridiculed, or, if they do manage to convince some people to buy, get yelled at when the price takes an almost unavoidable downturn.

Trying to convince people on bitcoin is a thankless mission. You really have to do your own thinking on this.

Bitcoin is an asset for long term saving, not for speculating

If you do decide you want to do something about the hamster wheel problem, don’t try to be smart with timing the market – that’s behaviour of someone who still has those dollar signs in their eyes, chasing, running… just like they need you to be.

Nobody can time the market reliably. We’re really in an uncharted territory – the discovery of an absolutely scarce asset is a once in a civilization event, and we have no idea how the price action will play out. It can reasonably be expected that the journey will be volatile…

…but even that is unclear now that the nation states are starting their race to get their part of this extremely scarce asset… before their competitors can get more than them. Unlike gold, bitcoin is the first asset in the history of humankind where the supply doesn’t go up when the price increases!

I really don’t know what will happen with the price in the short or medium term, and neither does anyone else. Don’t think you can predict the short term price fluctuations, and instead study bitcoin and keep in mind that there can only ever be 21 million – and nobody can print more.

The best way to do bitcoin is to first study it, and then understand that it is a LONG-TERM savings account. If it’s money you need in the next year or two, maybe put it in the stock market instead and sleep tight. If you put it in bitcoin, the volatility may really hurt you (drawdowns of 85% have happened, and can happen again). Get in for the long term and strap in tight, because the ride will be rough. Accept the volatility – this is very much worth it – and study more!

This is about much more than just your finances...

There's something strange that happens for people that understand bitcoin: the whole way they see the world (not necessarily their "world view!") changes. They usually become much calmer and future-oriented.

The reason for this is clear: even if you can't get off the hamster wheel immediately, just the knowledge of that being possible for you, realistically in your lifetime without winning the lottery, is an extremely profound change.

People who don't understand this are prone to living in the "here and now", because the future is so uncertain and seems to just be filled with more work and increasing bills. Not really something to look forward to!

When you know you have a chance of winning in this game, you start to think of stuff other than money: primarily your health and relationships - also your relationship with your job, which is arguably the main relationship for many.

This process goes on in all areas of life, putting things in a positive perspective.

It is perhaps for this reason that bitcoiners are sometimes mistaken for "cultists". While there are some tribalist elements to this, it really is more about this process of "fix the money, fix the world" playing out on a personal level - for multiple people at the same time. Nothing about this is "a religion" (some of it can be about spirituality, as can everything).

General "doomerism" is rare among bitcoiners - for us the future looks bright, and not just financially. For example, it matters little what happens with politics, as we understand the reason(s) why ultimately bitcoin will fix this.

You might want to get some in case this catches on. It will help you go from being a high time preference individual to High Future Preference!

"But the price is so high!"

You need to zoom out and look at the big picture: is the price high compared to the amount of fiat they need to print in the future, or to some past price?

If you're worrying about the latter, you're probably thinking of how much fiat gains you've "lost" by not buying at whatever past price. In other words, you have those dollar signs in your eyes... and that's how you know it's time to rethink this.

Money is not about... money. It is about purchasing power: what can you exchange that money for in the future?

The purchasing power of bitcoin fluctuates wildly in the short term: all kinds of high time preference gamblers are speculating on this new asset like there's no tomorrow, and that causes wild swings in both the fiat price AND purchasing power. That's why bitcoin isn't a short-term savings vehicle.

However, in medium+ term, no one can change the fact that there are only 21 million. Everything that is measured against it is constantly changed.

These two things create the bitcoin price cycle: 95%+ of the time, the price is below some past peak, and people think that means it's going to zero and don't touch it. These would be good times to buy, but regular people can't mentally get over that past peak.

When the price is above any previous peak, everyone apes in at once and the price "overheats"... temporarily.

Meanwhile, over 5+ years, the purchasing power only goes up, as more and more people catch on to what is really going on: the discovery of sound money through an absolutely scarce asset that can't be printed or inflated in any way - and what that means for humanity.

What it means is that everyone wins - even those who never "buy" bitcoin but ultimately earn it as wages. Those wages keep their purchasing power without ever having to play any financial games, enabling regular people to get a fair pay AND be able to save again. This is why bitcoin is not a pyramid scheme - in the game of sound money everyone can win!

If you buy bitcoin before others earn in it, maybe you can help some of those who didn't buy by hiring them in the future!

0 Comments