Taxes are purposefully hidden from most people

When it comes to taxes, people think of numbers – percentages more specifically, because that’s how the taxes are calculated and presented to them. In most countries, the percentage that people widely see as “how much tax they pay” is their income tax percentage – the part that they are told is taken out from their salary.

This is misleading in many ways, and it is misleading by design. If people understood exactly how much tax they do pay, it would be much harder to make them pay even more. The greatest trick the taxman ever pulled was to hide the taxes by making them invisible to the average Joe.

For example in my home country Finland, if asked, most people might say that they pay maybe around 30% of their income in taxes – that’s roughly what an average person pays in direct income tax (the part they are told about in their tax return). Of course, they don’t really “see” that tax except once per year when they are presented with their tax calculation (a multi-page spreadsheet).

Even then most people are primarily concerned with how much money will be returned to them: how much they overpaid last year. The overpaid part is returned – which most people think of as “getting money from the government”.

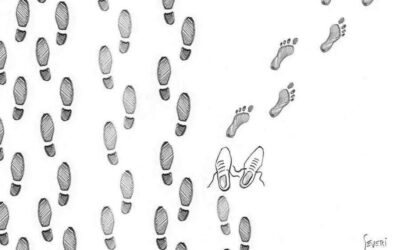

When the tax is actually paid to the government from their monthly paycheck, they don’t see it – it is automatically deducted before they see anything in their bank account. They don’t personally perform the act of paying the tax – it is taken from them before they even see that money. This is the way with almost all taxpaying is done – out of sight, out of mind… but paid in full.

The total amount of tax is much greater (3/4) than just the income tax

Of course, if you understand even basic math and scratch the surface a little bit, the feeling people have about “maybe around a third in tax” quickly turns out to be untrue. A very detailed, thorough and transparent calculation was made in 2019 by Pauli Vahtera (original text in Finnish). He didn’t just settle for looking at the simple income tax percentage, but asked a different question: out of every euro an average person earns, how much of it goes to the government?

Pauli looked at this through a wider lense and thought about the whole process of a person creating value for their employer, paying all the government fees, taxes and duties, going all the way to spending or saving that value over a typical year for a typical person. Of course, this isn’t a fixed percentage because there are a wide variety of different taxes and circumstances, so Pauli assumed an average couple living a normal Finnish life, earning average wages, and looked at all the ways they pay money to the government over a year.

The END RESULT? Out of their total earnings, the average couple had a total tax burden of 74%! You read that right – seventy four cents of every euro earned went to the government.

Remember, this calculation was done over 5 years ago – taxes have only gone up since then. They’ve probably gone up more than just one percentage point, but let’s round this down to an easy-to-handle 75%, or three quarters.

Taxes as a percentage of time

Another way to look at this percentage is time. Time is money, and conversely you can think of money as time. When looking at taxes this way, it is correct to say that of the total time an average Finn spends working, three quarters of it is working for the government. Let’s look at what this means:

Out of an 8 hour work day, 6 hours belongs to the government.

Out of a 5 day work week: Assuming the typical Finnish work day of 08:00-16:00 and a 5-day work week, 0.75 x 5 = 3.75 days = 3 days and 6 hours, ie. from 08:00 Monday morning until 14:00 on Thursday afternoon is government work.

Out of a month, roughly three weeks.

Out of a year, 9 months.

Out of a 40 year career, 30 years.

So to answer the question in the headline, “what part of your life should be forced government labor?” – the Finnish welfare state current status quo is “the vast majority of it”.

Personally, I think that’s just not cool. That wasn’t my main motivator for moving out of Finland, but it is certainly my main motivator for not moving back there!

Other countries aren’t that bad, right?

But surely this is just the case with the (semi-socialist) republic of Finland, and other countries like the United States are still free and the taxes are low?

Well, not really. They are certainly not quite as high as in Finland, but even in the “free and capitalist” United States the total average tax burden is not low. I’d throw a guess that if a similar calculation was performed for the average US taxpayer, the end result might be somewhere around 50%. In other words, in the “capitalist” US 6 months out of the work year would belong to the government.

Other western states are probably somewhere between US and Finland, ie. by moving from one country to another, you can freely choose to work between 6 and 9 months out of the year for the government of that country. What lovely freedom we have in the free and democratic west!

What can you do?

You could try voting, but voting is exactly what has gotten our societies into this mess in the first place (2 wolves and a sheep problem). Can you vote with your feet for slightly saner forced labor quotas? Yes you can – but this is of course a complex topic and will be discussed in more detail in later posts. Suffice to say that in order to do much anything in this direction, the first requirement is moving out from your country of origin.

In a nutshell, these are your options:

1. Stay and do what an increasing number of people are doing: join the wolf pack. Stop working, live on welfare and vote harder for more benefits.

2. Stay and keep at your job. Work for the government for the majority of your life, and be happy to perform that labor. Well, you don’t necessarily have to be happy about it, but you will pay the wolf pack what the wolf pack says is due – or else!

3. Choose not to stay and seek better life elsewhere. Not every country demands you to give them 50%+ of your life energy. Let Sovereign Landing help you move!

0 Comments