Two recent tax horror stories have caught my eye. If you’re a productive individual in a high tax country, you should pay attention so you don’t become next!

These are not full blown “justice murders” – just more everyday examples of the tightening noose around the neck of the productive people. Both of these highlight the growing disconnect between what is the law, and what can be considered “justice”.

Why the governments won’t be able to stop hunting productive people

As Milton Friedman said, you shouldn’t be looking at what the government is demanding you to pay them in any specific year – you should pay attention to what they are spending, because that will determine what you will need to pay, sooner or later. They will come for that money either through taxes or inflation, because they have no choice.

It’s not hard to predict that “the next round of tightenings” is coming, because the governments are spending like there’s no tomorrow.

Of course, they don’t think there’s no tomorrow – they just don’t care whether there is a livable tomorrow for you. Your job is to do the paying – it is the law. Whether you like it or not, it stays the law, and they keep spending accordingly.

If there ever was a time that the politicians would do something about this, it would be now. The US debt is screaming upwards at a mind-boggling pace (and it’s not like other western countries are any better off financially). There is an ongoing presidential race, and this giant fast-ballooning elephant in the room is not even a topic of discussion.

The politicians won’t be coming to save you – they will be coming for you! They have no choice.

To get an idea of what they might have in store, let’s look at these two recent cases.

The bureaucratic inquisition

The first case is a friend of mine, who in 2018 did what was common at the time: he shuffled his “crypto portfolio”. He didn’t take out any “fiat gains”, ie. transfer any money to his bank account, just traded one cryptocurrency to another. This was in 2018 and the world was a bit different – these tokens were just beginning to be considered “money”, but normal people didn’t really think that way (the taxman did, as you’ll see later).

The other case is this Youtuber who got audited for taxes. The headline of the video says “$500 000 fine”. It wasn’t really a fine, just “regular tax” on top of other things he has to pay, but the IRS did get that money. That is not the really noteworthy point though…

The real point is that these tax audits are an excruciating process, a bureaucratic equivalent of being investigated by the Spanish Inquisition. You’re considered guilty of tax evasion unless you can prove your innocence.

You’d better have those records in 100% order, or else!

Better have your reading of the ever-changing vague tax code exactly “right”, or else!

Better have caught every tiny insect in their buzzing tax swamp, or else!

Failing to comply is criminal…

That Youtuber was lucky and he and his of accountants and tax consultants had done a good enough job, and he was able to get away without being branded criminal.

My crypto-portfolio friend might not be that lucky. The tax man came after him late this year (2024) for his 2018 trades. Because his (probably imaginary) “gains” were over some arbitrary threshold of a very low 5-figure amount, he is now under investigation for criminal tax evasion.

Now, shitcoining may be a sin, but being branded a criminal for changing a token for another? That is a bit much… but it is the law.

Later update: this story now seems even worse...

After publishing this post, it was pointed out that the whole reason this is happening is that the tax authorities changed the rules on the fly with an administrative decision in 2018 (source in Finnish). It wasn't even a change in law, just a change in the interpretation of the law - and they did this in silence and didn't even bother telling anyone until much later.

Now, I'm not going to argue whether my friend should or shouldn't have known, or whether his trades were done pre- or post-change. Don't know, don't care, besides the point, which is this:

How on earth is it possible that people are being labeled criminals based on these kinds of obscure hidden changes in the interpretation of the tax code?

How is an ordinary person supposed to keep up with any of this?

The answer, of course, is that it doesn't matter - their job is to pay, fair or not.

A more conspiratorially minded person might even say that this is by design, but I'm sure it's just massive incompetence. It's not like the people actually responsible for these blunders would ever pay the price for them - it's the citizens that suffer the consequences.

I'm so very, very glad that I'm personally no longer a helpless subject of those swamp creatures!

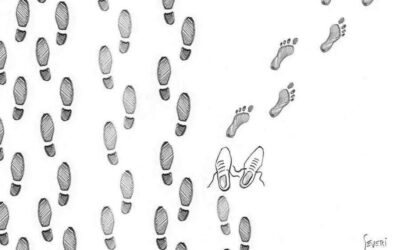

…what is defined as criminal may have little to do with justice

The governments are indebted to their eyeballs, and the government makes the laws. The bureaucratic inquisition will only get more powerful, and dusty old financial records will be inspected with much tighter scrutiny. Doesn’t matter who’s in office – you better have those records in order. It is your duty after all, according to the law!

It isn’t enough that the government is asking you to give them over half of your life energy – it is also necessary to have a side job just to know what to pay. Get that puzzle wrong and they will make you suffer!

For business owners, it means you have to employ your own side of the bureaucrat army. Maintaining that defense is expensive, but in high tax countries you don’t have much choice. You don’t want to get made an example of, do you?

If you value your peace of mind and care about your reputation, you have a pressing need of moving somewhere where productive people are not treated like criminals.

Not all governments are equally bankrupt, and foreign governments don’t see you as their tax cattle!

Moving is not as difficult as changing the laws, but that doesn’t mean it’s easy. Sovereign Landing makes it a breeze to arrive in a new country, so check us out and avoid becoming the next target!

Update a few hours after publishing: I want High Future Preference to be more about solutions and less about problems – this post is maybe focused too much on the latter. Without making this post too long, I want you to know that practical freedom from tyrannical governments is already possible today, so don’t despair! I’m working on content on that – meanwhile, I’ll just leave you with this video. It’s funny cause it’s true.

0 Comments